Worrying about war: geopolitical risks weigh on consumer sentiment

By Olivier Coibion, Dimitris Georgarakos, Yuriy Gorodnichenko, Geoff Kenny and Justus Meyer

Military and diplomatic conflicts harm economic growth. This ECB blog shows that the expected length of wars matters for how strongly they weigh on consumer sentiment.[1]

Geopolitical tensions can make consumers worry about their personal financial future and the economy at large. Data from the ECB’s Consumer Expectations Survey (CES)[2] suggests both notable concerns about geopolitical tensions and signs of deteriorating consumer sentiment during the second half of 2024. The share of consumers who expect a recession and anticipate a worsening of their own financial situation started to rise after summer 2024 and remains high (Chart 1). The growing concerns about the personal financial outlook are particularly surprising given that at the same time real incomes recovered, reflecting recent higher wage growth and declining inflation.[3]

Chart 1

Euro area consumers’ sentiment, recession expectations and durable consumption plans

(left axis: percentage of consumers, right axis: year-on-year change in percentage of consumers)

ECB Consumer Expectations Survey (CES), latest data: February 2025.

Notes: Population weighted data. Each month, consumers are asked in the CES about purchasing plans for durable goods. In blue (right axis), we show the year-on-year change in the percentage share of consumers who plan to purchase cars or home appliances over the next 12 months. Year-on-year changes are calculated to account for seasonal effects. Consumers who expect their financial situation to be “somewhat” or “much worse off” 12 months from now compared to today are depicted in red (left axis). The CES also collects monthly expectations about economic growth and the yellow line (left axis) shows the percentage of consumers who expect the economy to shrink over the next 12 months.

It is plausible to assume that consumer concerns about geopolitical risks weigh on broader economic sentiment. To test this link, we confronted consumers with different geopolitical scenarios. Specifically, the CES in September 2024 asked each participant to consider one out of three scenarios regarding the duration of two current military conflicts: the war in Ukraine and the conflict in the Middle East. The three scenarios were: i) an immediate or relatively swift end of these conflicts (within three months); ii) a one-year prolongation; and iii) an extension of three years or more. The survey then asked respondents to rate how their given scenario would affect their economic expectations for themselves and for the whole economy over the next twelve months. Answers were given with a 5-point scale ranging from “increase (a lot)” to “decrease (a lot)”.

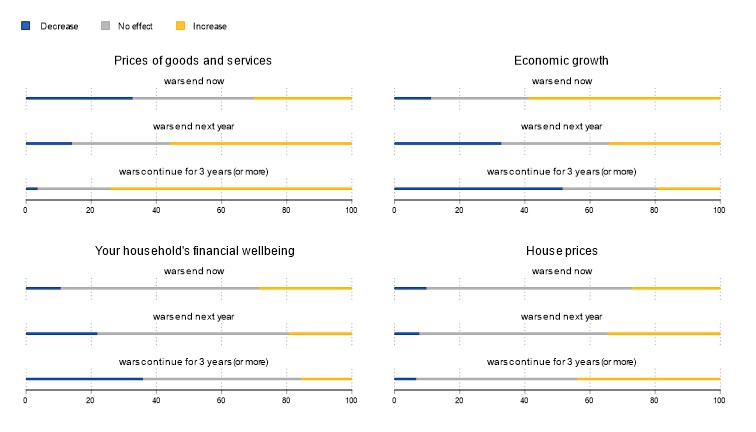

Our results (see Chart 2) show that household expectations are highly responsive to the different durations of the wars. Consumers generally associate longer conflicts with a less favourable economic outlook, for both the economy at large and their household. In particular, they expect higher inflation and significantly lower growth as a result of a longer conflict duration. Consistent with earlier research, this suggests that consumers could associate prolonged wars with supply-side shocks. That could reflect, for example, consumers remembering problems with energy supply and rising energy prices at the beginning of the Russian invasion of Ukraine.[4] Households also expect a worsening of their own financial wellbeing with longer-lasting conflicts That said, they expect the impact on the financial situation of their households to be smaller than for the whole economy.

Chart 2

Different duration scenarios of geopolitical conflicts

Consumers’ expectations one year ahead - under different duration scenarios of geopolitical conflicts (percentage of consumers, by scenario)

Source: ECB Consumer Expectations Survey (CES), September 2024.

Notes: Population weighted data. In September, respondents were presented with one of three scenarios “Suppose that the war in Ukraine and conflict in the Middle East {end by December 2024 / continue in the course of next year and end by December 2025 / continue in the next 3 years (and possibly beyond)”, and then asked, “How do you think this will affect (if at all) each of the following in the country you currently live in, over the next 12 months?” on a 5-point-scale from “decrease a lot” to “increase a lot”. For analysis, responses indicating "decrease a little" and "decrease a lot" were combined, as were those indicating "increase a little" and "increase a lot”.

One possible explanation for that discrepancy is that households may consider themselves as relatively insulated from the wider downturn in the economy. This could be because they expect government support or social security provisions, at least over the subsequent twelve months.

Consumers’ house price expectations also appear relatively insensitive to the duration of the conflict. This could reflect the relative resilience of many euro area housing markets in recent years. Consumers might also see home ownership as a safe haven in periods of economic turbulence.

Prolonged conflict weighs on consumers’ expectations

CES data also suggest that reduced consumer sentiment in response to geopolitical tension may translate into weaker actual spending. This in turn could ultimately reduce overall economic growth. In the December 2024 CES, we asked people directly how concerned they were about the impact of geopolitical tensions on their household’s financial situation. The results in Chart 3a show that people are quite concerned. However, not all consumers are equally concerned. People with lower income and those who do not have much money at hand are relatively more concerned about geopolitical risks compared to more affluent households. In short, geopolitical conflicts make poor people worry more about their economic situation than those with higher incomes.

Chart 3

The link between geopolitical concerns and consumer sentiment

a. Geopolitical concerns in December 2024 |

b. Concerns and consumer sentiment |

|---|---|

(percentage of consumers) |

|

|

|

Source: ECB Consumer Expectations Survey (CES), December 2024.

Notes: Population weighted data. In December, consumers were asked “How concerned are you about the impact of the current geopolitical events on the financial situation of your household, over the next twelve months?”. The left panel shows the distribution of responses among euro area consumers. The right panel shows the association between financial sentiment, crisis beliefs and perceived job-loss probabilities, on the y-axis, and geopolitical concerns, on the x-axis (see Chart 2). Consumers are asked “looking ahead, do you think your household will be financially better off or worse off in 12 months from now than it is today?” (financial sentiment), “What is the probability that there will be a financial crisis affecting the financial system and the economy in your country in the next 12 months?” (crisis beliefs) and, each quarter, “What do you think is the percentage chance that you will lose your current job during the next 3 months?”. Respondents’ job loss expectations were collected in October 2024 for employed consumers. The linear fit accounts for country fixed effects.

We are also able to examine the possible connection between the broader level of concern about geopolitical risks with consumers’ expectations about their own financial situation. As shown in Chart 3b, we find that that consumers who worry most about geopolitical risks are much more likely to expect a worse overall financial situation for their own household compared with those who are less concerned. Also, they perceive a higher chance of losing their job and an increased risk of a financial crisis.This makes them cautious in their economic decisions. Our findings, therefore, suggest that geopolitical concerns play a role in holding back consumer spending and thereby ultimately drag on growth in the euro area.

Taken together, our analysis indicates that consumers not only worry that wars are ongoing. It matters a lot how long they expect wars to last. That seems to heavily influence their economic outlook. While expectations about aggregate price changes and economic growth are most affected by geopolitical risks, there is also a clear link to deteriorating consumer sentiment. These results suggest that prolonged geopolitical conflict can inhibit spending and drag economic growth, even during times when real incomes are rising.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release